1. Background

Financial Planning is an on-going process to help you make prudent decisions about spending, investing, and multiplying your income and assets to help you achieve your desired financial goals and dreams.

In layman terms, Financial Planning is nothing but identifying the sources of the funds and investing these funds in suitable avenues, which ultimately help in achievement of the financial goals and dreams. Insurance planning is one of the key element of financial planning and we have discussed the same in detail below.

2. Why Insurance is a Necessity

As everyone knows that Life is uncertain and one can never predict what the future holds. Whether it is possible to predict the timing of our death? The answer is No. Is it even imaginable what will happen to our family after our death? These imaginations are scary and one should not dwell much in to this since it is beyond one’s control.

However, the right question could be what can we do so that our family have to suffer minimum loss from your death. As someone has rightly said, every life has immense value and hence it may be an exaggeration to say that it is possible to cover the risk of loss of life since the grief for family members may be immense. However, it is possible to make sure that one’s family is financially secured in his absence also by making an appropriate Insurance Planning.

Insurance planning is to protect yourself, your family and loved ones, your home, your assets, or your business against unexpected events. It is a critical component of a comprehensive financial plan that includes evaluating risks and determining the proper insurance coverage to mitigate those risks. The principal goal of insurance planning is to identify and analyze risk factors of one’s life/ business and seek proper coverage to attain a peace of mind if disaster strikes. The chances of recovering partly or fully are assured by having commensurate insurance. Therefore, insurance is an economic device transferring risk from an individual to a company and reducing the uncertainty.

As it is said “LIFE” is full of IFs and most of us have big plans in their mind for the future but achieving those dreams depends on many IFs. As you would agree that most of us have few common events lined up for future which require huge financial commitment eg buying a dream home, repayment of existing debt/ loan, higher education of kids, marriage of son/ daughter, medical need of parents, continuation of existing lifestyle of family, etc. As these events are very common for any human being, it is highly advisable to prepare and put in place a financial plan to secure their loved ones against many IFs of Life.

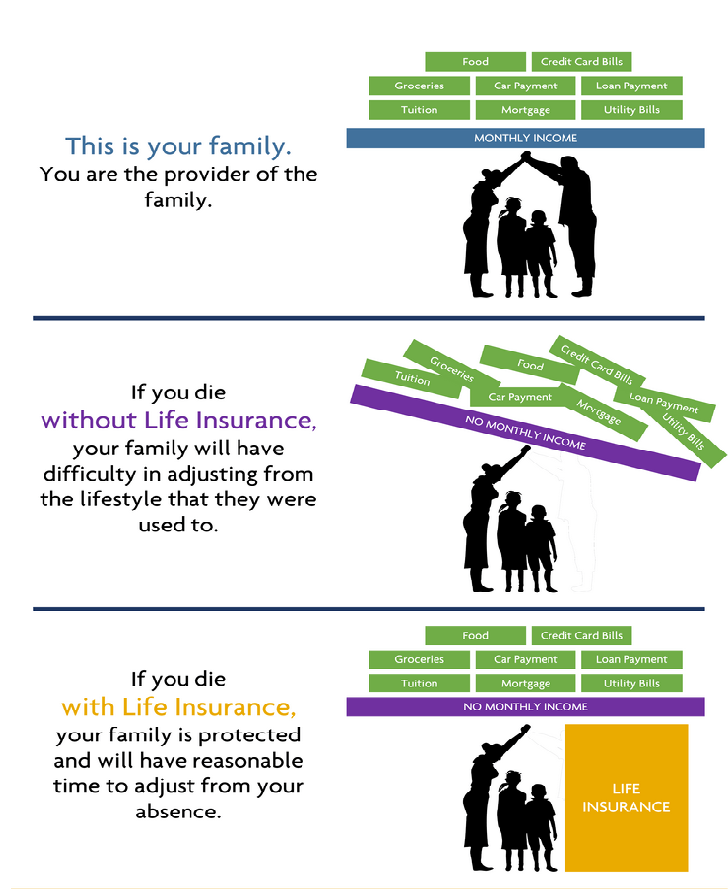

One first element of financial planning is to buy a reasonable amount of Life Insurance as Life is the most uncertain thing which is surely going to occur. While you may have a great financial plan to build wealth over next 15-20 years, but same would be of no help if you die natural or by accident or by a victim of COVID-19 during the course of achieving it. Hence, Insurance is a must to safeguard the financial security to your family. The following depiction truly sums up the need of buying a life insurance:

Primarily, following are the two types of life insurance plans available in India:

- Term Insurance (Pure Risk Cover Plan)

- Traditional Life Insurance (Investment-linked plans)

- Unit Linked Insurance Plan (ULIP)

- Endowment Plans

- Moneyback Plans

While most of us are aware of Traditional Life Insurance, not many are aware of the concept of Term insurance in India or how the term insurance plan operates. Given the same, we have discussed in detail the key features and benefits of subscribing to term insurance as it is the need of an hour considering the situation we are sailing through.

3. Term Insurance – Key Features

Term Insurance Plans are the simplest and most affordable form of Life Insurance as it promises to pay an assured amount only if the insured person dies during the term of the policy. In the event of death of an insured person, the sum assured would be paid to the nominee which ultimately assure your loved ones to enjoy the life on same status as they are enjoying as of now. While there are options available to opt for return of premium option if the policy holder survives the entire policy term, however, under pure term plan, there is, usually, no maturity benefit payable under this plan. Therefore, terms plans called pure protection plans.

Against this, Traditional life insurance plans, like endowment or money back plan, have a saving element in them. They promise to pay either a death benefit in case of death during the term or a maturity benefit if you survive the term of the policy. However, the maturity benefit, per se, would be very negligible and unattractable if one considers the inflation and other investment avenues available.

As against this, higher level of sum assured at very affordable premiums is the only important factor which differentiates a term insurance plan from other plans of life insurance. While traditional plans might give you guaranteed returns, term plans offer you the option of getting a sufficiently large sum assured at a very low cost. Eg – A person aged 25 can get a term insurance of INR 1 crore by paying a premium of only INR 10,000-12,000 per annum. Buying such a low-cost plan allow you to give your family a complete sense of financial security in any unfortunate event of your death.

Given such features, wealth managers advise their clients to buy term insurance first as it provides a pure life cover and further, they are comparatively inexpensive and most affordable when compared to any other form of life insurance plan.

4. Term Insurance – Key Benefits

Considering the key feature of Term Insurance, you would now agree that actually there is no choice but to opt for pure risk coverage plan i.e. term insurance. We have summarized below the key benefits of pure term insurance:

- Massive coverage with low premium

This is one of the biggest benefits of term insurance plan. A person having an income of INR 20 lakhs can even take a insurance of INR 5-7 crores at a reasonably low premium. Further, earlier you take the policy, lower will be the premium amount and same would be constant for the entire premium paying term.

- Provides life-long coverage

Term insurance provides life-long coverage i.e. coverage for 40 years from the date of availing policy or even up to 100 years of age. Accordingly, taking longer coverage would provide you certainty that it would most likely be matured and would not lapse.

- Return of premium

Now a days, companies have also launched term plan which provides return of premium plan wherein if the policyholder survives the policy, he or she will get a maturity benefit in terms of all the premiums paid.

- Waiver of premium

Under this feature, the premium is waived in case the policyholder gets critically ill, seriously injured or disabled and the policy is continued. This may be useful in a situation where income is impacted due to an unfortunate event and ability to pay premiums is compromised.

- Terminal illness

If one opts for rider of terminal illness and in case, insured person got hospitalized with specified terminal illnesses, 50% of sum assured would be paid upfront to the family member. This would help the family member to use money on medical treatment to save him which may even save the person.

- Optional Riders

Other riders in form of accident insurance benefits, etc. are even available wherein if person die due to accident, twice the sum assured would be paid to the family.

5. Income-Tax Benefit of Term Insurance

Section 80C of the Income-tax allows a deduction up to INR 150,000 for the premium paid towards term insurance and thereby depending on the tax slab rate the person paying premium is falling into, he can save the outflow of tax up to an amount of INR 55,000 every year. Further, the maturity amount received on death is also tax-free under Section 10 (10D) of the Income-tax Act.

Further, Companies or Firm can also take the term insurance of their keyman to safe guard themselves against his death. The `keyman’ would be any person employed by a company having a special skill set or substantial responsibilities and who contributes significantly to the profits of that organization. Further, company buying keyman insurance can claim a deduction for the premium paid for the policy as a business expense under Section 37(1) of the Income Tax Act. However, the amount received on death is not exempt under Section 10 (10D) of the Income Tax Act. There are ample of planning avenues available to take the term insurance to gain the maximum tax advantage within the four corners of Law. However, it depends of fact of each case and in case, you wish to evaluate the available options, you can reach out to us on manifestwealthadvisory@gmail.com

6. Still, what is holding you back

Every one of us knows deep down that they need life insurance, but most of us don’t have an adequate policy in place. While some have traditional life insurance policies but the sum assured seems not enough considering the future lined up events such as payment of loan, education, marriage, etc.

Most of the people, may be including you, hold back to buy life insurance as they just don’t want to think about their mortality or consider insurance as a dead investment. While we would buy the insurance for non-living product such as car as we would like to secure the financial risk in case of loss of car or accidental damage of car, but we would not buy the insurance for the most precious thing ie LIFE, one of the greatest ironies of the world.

Consider for a moment situation like you are affected by COVID-19 and due to unavailability of proper medical treatment or other health issues, you lose your life and leave your family alone to survive. Resultantly, your family will become the victim due to your sudden death and that too without having any sizeable Life insurance plan in place. This would leave your loved ones financially vulnerable leading them to forcibly living a miserable life. Imagining event like this is even scary then just think about how scary the reality would be. Trust, now you would have overcome all the excuses for not buying a term insurance and would take a step forward to secure the financial future of your family.

7. Concluding remarks

Given all the above, you would certainly agree that Term Insurance, being very low priced and straightforward, is the best and simplest kind of life insurance that continues to cover and protect your loved ones even when you are not there.

Considering the current situation the entire world is going through and accepting the fact that this highly uncertain time would going to last for a fairly long time, it is advisable to have a look at your financial goals, dreams and compare it with the life insurance you possess currently and if you are of the opinion that it would certainly not take care of the future of your family, don’t even delay a single day to buy the commensurate size of Term insurance. Having a sizeable amount of life insurance would guarantee you that your family would appreciate your decision in their life after your death.

While there are many factors which you must decide before buying a term insurance eg how much should be the term of the policy, how much sum assured you require, which rider to add-on, which policy to take, etc. and hence, it is very important that you buy any term insurance after having detailed discussion with the financial advisor as it can be the most important financial source of income for your family after your death.

You can definitely reach out to us on manifestwealthadvisory@gmail.com